Your End-of-Year Financial To-Do List (Don’t Worry, It’s Painless)

The end of the year has a funny way of sneaking up on us. One minute you’re recovering from Thanksgiving, and the next minute you’re wondering how it’s already December 31. Before we officially turn the page on this year, now is the perfect time to knock out a few simple financial to-dos that can set you up for an easier, smarter New Year. No stress. No complicated spreadsheets. Just a handful of quick wins.

Here’s your end-of-year financial checklist.

✅ 1. Take a 10-Minute Reality Check on Your Spending

You don’t need a full budget overhaul right now. Just take a quick look at:

Your last one or two bank statements

Your most-used credit card

A few subscriptions you forgot you had

Ask yourself one simple question: “Is my money going where I actually want it to go?”

If the answer is “mostly,” you’re doing better than you think. If the answer is “not even close,” that’s okay too. Awareness is step one.

✅ 2. Clean Up Subscriptions and Automatic Payments

Streaming services, apps, gym memberships you swear you’ll use again… this is where money quietly leaks all year long. End of year is prime time to:

Cancel anything you haven’t used in months

Downgrade plans you don’t need

Update any expired cards tied to important bills

Pro tip: Even canceling two $15 subscriptions puts $360 back in your pocket next year. That’s real money.

✅ 3. Check Your Credit Score (Yes, Even If You’re Afraid)

Your credit score affects way more than future loans. It can impact:

Insurance rates

Utility deposits

Apartment approvals

And of course, loan interest rates

So this is the perfect time of year to take a quick look and see where you stand.

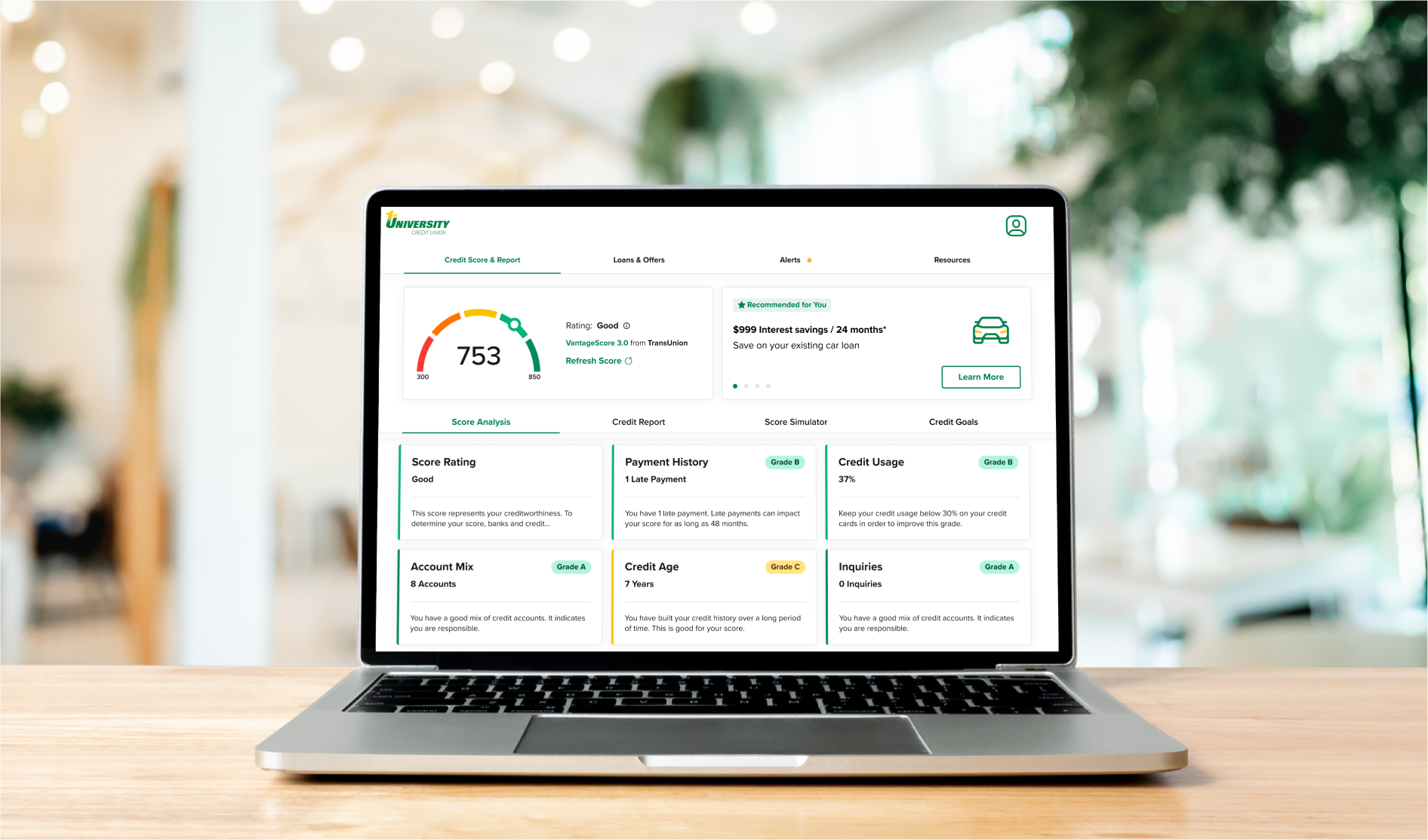

And good news — you don’t have to hunt down a single thing. SavvyMoney inside your online banking and mobile app makes it ridiculously easy to check your score, view your full credit report, track changes, and get personalized tips to improve it.

If your score went up this year, celebrate that win. If it dipped, SavvyMoney can help you figure out why and what small steps can give it a boost next year.

✅ 4. Revisit Your Savings Goals (Big or Small)

Maybe you’re saving for:

An emergency fund

A down payment

A vacation

Or just breathing room

Even small changes add up. Increasing your savings by $25 a month equals $300 next year plus dividends. You don’t need perfection. You just need momentum.

✅ 5. Pull Together Your Tax Documents Now (Future You Will Say Thank You)

January You is already tired. Help them out:

Start a tax folder now

Save year-end pay stubs

Download interest and dividend statements when they arrive

Track any charitable donations

Being organized early turns tax season from chaos into “Oh, that wasn’t so bad.”

✅ 6. Decide One Smart Money Move for the New Year

Just one. Not ten. One.

Maybe that’s:

Paying off your smallest debt

Building a $1,000 emergency fund

Refinancing a high-rate loan

Opening a new savings account for a future goal

One small decision, done consistently, can completely change your financial confidence by this time next year.

✅ 7. Remember: You Don’t Have to Do This Alone

Financial wellness isn’t about being perfect. It’s about having the right tools and the right people in your corner. If you ever feel stuck, overwhelmed, or unsure where to start, that’s exactly why we’re here.

At 1st University Credit Union, Helping You Do Life isn’t just a tagline. It’s what we show up to do every single day.

A Fresh Start Starts Now

You don’t need a New Year’s resolution to improve your finances. You just need a next step. Wrap up this year with clarity, confidence, and maybe even a little pride in how far you’ve come.

And hey, if all you cross off this list is one thing, that still counts as a win.

Author: Shelley Carlson, EVP of Marketing and Relationship Management for 1st University Credit Union. She’s passionate about helping members make smart money moves and live life with confidence.