Credit Score

You can find it in Digital Banking — and it’s free!

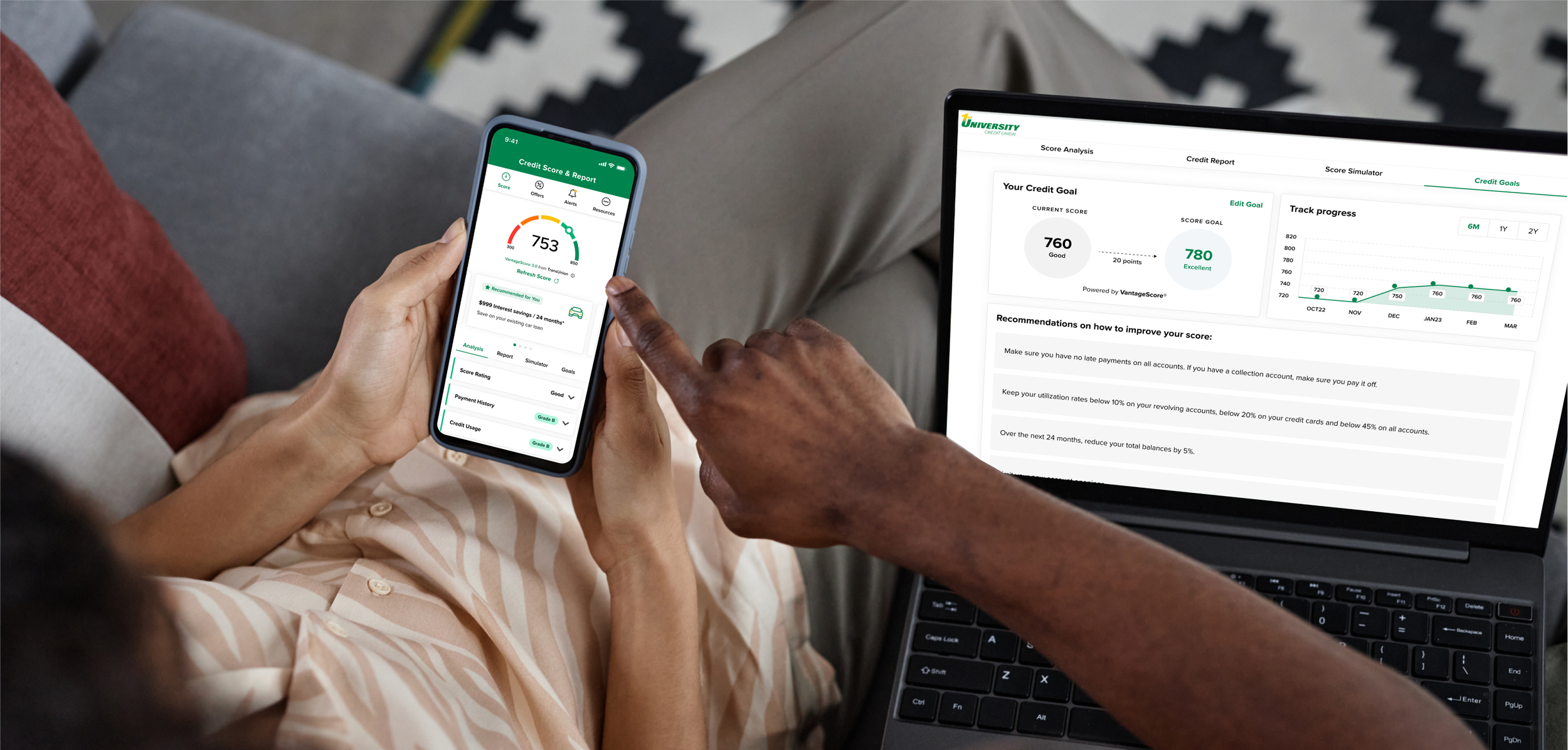

Seeing where you stand shouldn’t be hard. That’s why we’ve added SavvyMoney to our digital banking — both online banking and in the app.

With this free service, you can check your score, review your full credit report, set goals, and get tips that help you make confident money moves. All without impacting your score!

How it works

After logging in, accept the terms when prompted.

See your score instantly in digital banking.

Dive deeper for your full credit report, daily monitoring alerts, and personalized insights.

Explore offers tailored to your situation (only if you want to).

Quick navigation (what you’ll tap)

Online Banking: Dashboard → Credit Score

Mobile App: Home → Credit Score

Why your credit score matters

Your credit score is like a financial report card. Lenders use it — along with other information you provide — to help determine approvals and rates. The higher your score, the better your options tend to be. Keeping an eye on it helps you catch mistakes early and make smarter choices that keep your finances on track.

Good to know: People who monitor their credit regularly are more likely to see improvement. In one survey, 60% said their scores improved after they began checking, and 22% found an error or possible fraud while reviewing.

See your credit score instantly — right inside digital banking. It’s free, easy, and won’t impact your score.

What you can do with Credit Score

Check your score & report — free, any time. Looking doesn’t affect your score.

Get credit monitoring alerts. We’ll notify you about key changes to help you spot errors or fraud fast.

Set a credit goal. Track your progress with tips to help you improve. On average, goal users see a 30-point increase within 6 months.

Use the Score Simulator. See how actions — like paying down a card or opening a new account — might affect your score before you do them.

Try the Financial Checkup. Get a simple budget breakdown with ideas to manage money more effectively.

What affects your score?

Your score is calculated from information in your credit report. Five major categories make the difference:

Payment History – 40%

Credit Usage (utilization) – 23%

Credit Age – 21%

Credit Mix – 11%

Inquiries – 5%

SavvyMoney shows a VantageScore® 3.0 (range 300–850), a widely used scoring model developed by Experian, Equifax, and TransUnion. Age, income, and where you live are not included in your score.

Soft vs. hard inquiries: Checking your score here is a soft inquiry — it won’t impact your score. Lenders pulling your credit for a loan is a hard inquiry and can affect your score.

Your privacy and control

Using Credit Score is optional. You can opt out any time in digital banking and opt back in whenever you’re ready. It’s always free. If you spot an inaccuracy, you can dispute it from the TransUnion report view in SavvyMoney or contact the reporting company directly.

Getting started

Log in to online banking or the mobile app

Tap “Credit Score” and accept the terms

See your score instantly — then explore your report, alerts, and tools

Have questions? We’ve got answers.

What’s the difference between a credit score and a credit report?

Your credit report shows your detailed credit history — accounts, balances, and payment records. Your credit score is a three-digit number that sums it all up to represent your creditworthiness.

Why is my SavvyMoney score different from others I’ve seen?

Credit scores can vary because different lenders and apps use different scoring models. SavvyMoney uses VantageScore® 3.0, one of the most widely used models created by Experian, Equifax, and TransUnion.

Does checking my score hurt it?

Nope! Checking your score through digital banking is a soft inquiry, which means it won’t affect your credit in any way. Look as often as you like — it’s completely free.

Who provides the data behind my score?

SavvyMoney pulls your information directly from TransUnion, one of the three major credit reporting agencies.

How can I correct errors in my report?

If you spot something that doesn’t look right, you can dispute it right from your SavvyMoney Credit Report. Scroll to the bottom of your TransUnion report view and click “Dispute” to start the process.

Where else can I learn about credit and get a free report?

You can request a free credit report from all three bureaus once a year at AnnualCreditReport.com. The Consumer Financial Protection Bureau also has helpful resources to better understand credit scores, reports, and your rights.

Small print that actually helps

Checking your score in digital banking is free and does not impact your credit score.

Credit Score is provided by SavvyMoney and uses VantageScore® 3.0 based on your TransUnion credit report.

You can opt out any time in digital banking and opt back in whenever you’re ready.

For free annual credit reports, visit AnnualCreditReport.com or call 1-877-322-8228.

Remember: Checking your score regularly is one of the best ways to stay financially confident. It helps you catch errors early, track your progress, and celebrate every improvement along the way. Because knowing where you stand helps you do life with confidence. 💚💛

Don’t have our mobile app? Download it for free.

Credit Score — Free in Digital Banking

Seeing where you stand shouldn’t be hard. With Credit Score from 1st University Credit Union, you can check your credit score, review your full report, and track your progress right inside Digital Banking and our mobile app — powered by SavvyMoney using VantageScore® 3.0 from TransUnion. It’s free, easy, and won’t impact your score.

As a member-owned credit union based in Waco, Texas, we understand the Central Texas market and proudly serve McLennan, Erath, and Bosque counties — helping members monitor their credit, build financial confidence, and make smart money moves.

Helping You Do Life — with Confidence.